What Is A CIBIL Score?

Cibil score is related to all your financial transactions. CIBIL, or TransUnion CIBIL Limited, is an Indian company that calculates the CIBIL score based on your credit information. The company has access to all your credit details including financial transactions of borrowed and repaid money. CIBIL has access to credit information of about 600 million people and also includes 2400 lenders. It is the most trusted credit information company in India. A CIBIL score is a three digit number that ranges between 300 and 900. The CIBIL score is also referred to as the credit score.

Credit score is a rating that defines your credit worthiness. High credit score shows that you were handling financial transactions responsibly. You have borrowed and also repaid the amount duly. It is important that you maintain a healthy credit score as it shows if you can be trusted as a borrower. Lenders will judge you based on the credit score before deciding on your eligibility for a loan amount. Credit score will impact the loan amount and the rate of interest. Personal loans of collateral free loans will be sanctioned by reviewing the potential risk based on your credit score. Not just individuals, businesses and companies are rated based on their credit score. It is a crucial thing such that a business credit score will impact a company’s ability to attract investments.

How CIBIL Score Started In India?

Reserve Bank of India had sanctioned four companies to manage and access credit information in India. CIBIL is one of them along with High Mark, Equifax and Experian. CIBIL started its operations in the year 2001 and has become one of the most popular credit information companies in India. CIBIL score is calculated based on your credit history. If you have no credit history, your credit score is -1. If your credit history is more than 6 months old, your credit score will be 0. An ideal CIBIL score is above 750 and a score of 900 denotes maximum credit worthiness. Scores above 750 will help you qualify for a personal loan and credit card. You will find it tough to get loans from banks if your CIBIL score is less than 750. Scores close to 750 will also attract higher interest rates. So it is highly important that you maintain a higher credit score.

A credit report will have in-depth credit information based on which you will be given a credit score. It is a documentation that has all the highlights of your personal information, employment history, contact information, credit limit on various credit cards, balances, different accounts you handle and the dates you had opened it. This credit report is reviewed by the lenders and others before qualifying you for any loan amount. The credit report has four important sections, namely, credit summary, account history, public records, and credit enquiries.

Credit summary has details about your credit accounts you had in the past and you have currently along with the balance. Credit accounts can be credit card, car loan, home loan, loan against property, jewels or any other collection accounts. Account history will have the details regarding each credit account. The details will include the borrowed amount, amount repaid and pending, dates when the account was opened and payment made and a monthly payment record. The public records section will include things like bankruptcies, criminal arrests and any other financial slips. Credit enquiries will have details on any enquiries made on your credit information in a span of 2 years. Whenever any lender checks your credit information, it is considered as a credit inquiry. Too many credit enquiries will give an impression that you have made too many loan or credit card applications.

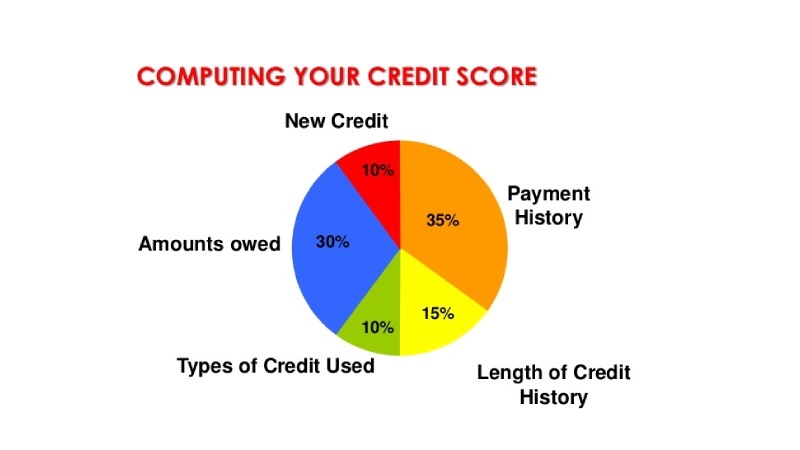

Computing Your Credit Score

There are several factors that go into calculating a CIBIL score. Every section of the credit report will be given a rating and a percentage of that will get into the credit score. The overall repayment history contributes 35% of the credit score. For a lender, it is important for them to know how well you have managed to repay all your loans hence the weightage given to repayment is the highest. The credit utilization and balance contributes 30% of the score. It will let the lenders be aware of the total credit that is available to you and how much you have utilized. Duration of availing credit contributes up to 15% of the credit score. It gives an idea about repayment duration and the timely repayment. Your credit score is impacted every time you enquire about a credit as it contributes 15% of the credit score. The credit mix is given a 10% weightage. It is always good to have a mix of secure, unsecure, short term or long term credits. If you have a credit card, home loan and a collateral free personal loan, it is considered as a healthy credit mix.

Know More About : Smart Tips To Boost Your CIBIL Score